how to lower property taxes in texas

There is no fee unless you save actual tax dollars. TEXAS STATE PROPOSITION 2.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

. If We Cant Lower Your Property Taxes You Owe Us Nothing. The tax rate that is applied to the taxable value. If you get a reduction but not under the cap you owe us nothing.

The assessed value of the property. Three factors determine the Texas property tax bill for a property. Rising Property that Makes Lower Property Taxes in Texas Harder.

If you think that your property tax is higher than those of others with similar homes in the area you stand a good chance of having your property tax lowered. Property Tax Calculation The three factors are used by the county appraisal district to calculate the property tax. 3 hours agoAnd Texas voters have the chance in a May 7 constitutional amendment election to expand homestead exemptions that could lower the amount of property values upon which property taxes can be levied.

Due to the absence of state income taxes and a substandard sales tax of approximately 825 most of the revenue earned by the state has to be generated through property taxes. Texas 2019 comprehensive school finance reform law House Bill 3 also capped property tax increases from school districts at 25 percent. The Texas Taxpayers and Research Association estimates.

A property tax exemption may reduce the taxable value of the property. So if your property is assessed at 300000 and. Proposition 1 would freeze the frozen school property tax bills for the elderly and Texans with disabilities starting in 2023.

In passed Proposition 2 would raise the homestead exemption from 25000 to 40000 for school district property taxes. The propositions on the May 7 ballot would lower property taxes by shifting more public school costs to the state. The lower the value of your home the less youll owe in property taxes.

But they didnt solve it. Heres how two Texas constitutional amendments could lower some property taxes. Tax Code Section 1113b requires school districts to provide a 25000 exemption on a residence homestead and Tax Code Section 1113n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value.

Property taxes are still rising. In many states in the US counties collect property taxes to cover a variety of social systems including public transportation fire departments law enforcement education and public spaces. Definitive Guide to Lower Your Property Taxes in Texas.

Texas lawmakers tried to lower property tax bills during their 2019 session and a new report says they put a dent in the problem. Some people mistakenly believe claiming their home is worth less will hurt them later when they want to. In Texas a property owner over.

11 Mar How Can I Lower My Property Taxes In Texas. How to lower your property appraisal and hopefully your property taxes too A leader expert on protesting appraisals says homeowners can. Texas property taxes - what you should know how you can get them loweredDid you get your Texas property tax bill shocked at how high your property valua.

Tax cards are public information so you can go through them and find homes in your area with a similar build footage and age to demonstrate the fact to the assessors office and ask for a reduction in property tax. If your home is valued at 75000 for example but you have a 10000 exemption you are only taxed on the new value 65000 75k 10k exemption. If you dont meet the qualifications for a tax ceiling freeze but want to lower your property taxes there are other options that can save you money by homesteading a property in Texas.

There are two ways for homeowners to decrease their tax billsIt can also take up to ten years for an appraisal districts appraisal districts appraiser to agree to fix an appraisal valueAside from these two purposes Texas residents are eligible for property tax exemptions on the other hand. The first proposition would draw down property taxes for elderly and disabled Texans by reducing the amount they pay to public schools which typically makes up most of a homeowners tax bill. One of the ways to lower your property taxes in Texas is to qualify for any one of the different exemptions available.

10 hours agoAnd Texas voters have the chance in a May 7 constitutional amendment election to expand homestead exemptions that could lower the amount of property values upon which property taxes can be levied. Taxes arent rising as quickly as they would have. It would also lower their.

The most common one is a general homestead which reduces the property tax value on a home so that you pay lower school district taxes. This money is used in paying for and providing important services to Texas residents such as schools.

Why Are Texas Property Taxes So High Home Tax Solutions

How To Protest Your Property Taxes In Texas Home Tax Solutions

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

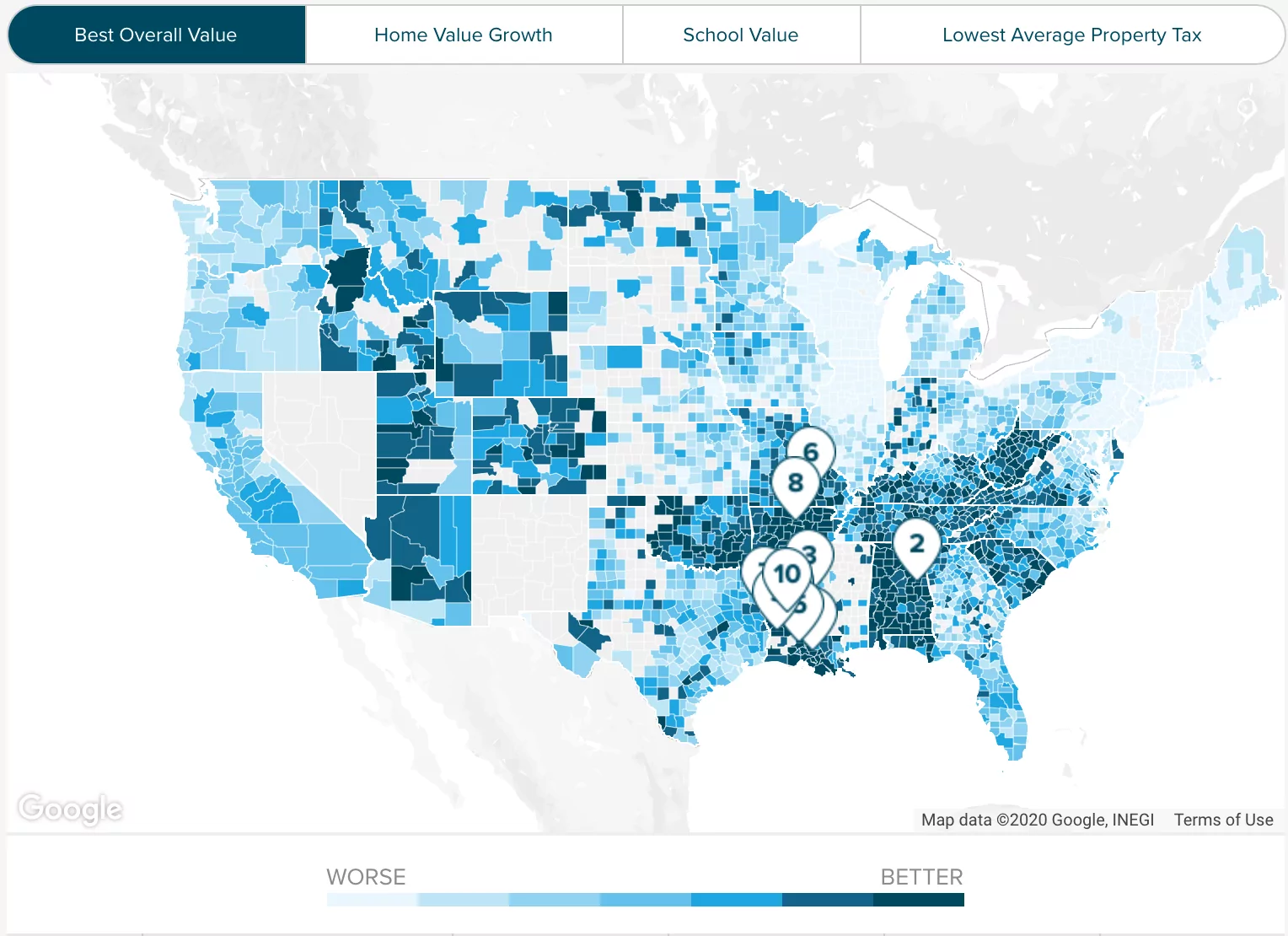

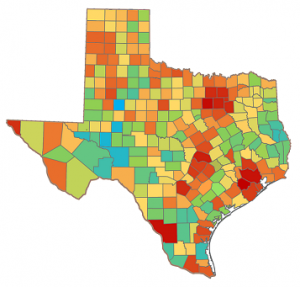

Tac School Property Taxes By County

Tarrant County Tx Property Tax Calculator Smartasset

Property Taxes In Texas What Homeowners Should Know

/https://static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

Texas Property Tax Trends Informal Hearing Reduction

Texas Property Tax Protest Tips Learn To Reduce Taxes

Over 65 Property Tax Exemption In Texas

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Tac School Property Taxes By County

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune

Tac School Property Taxes By County

/https://static.texastribune.org/media/files/7eaf54967fd9e1e99018c3430a2e7340/Aerial%20Suburbs%20JV%20TT%2002.jpg)

Texas Legislature Sends Property Tax Constitutional Amendment To Voters The Texas Tribune

Replace Property Tax Republican Party Of Texasrepublican Party Of Texas