how to claim california renter's credit

That being said each state has its own unique set of rules and we get into these specifics below. If you pay rent for your housing.

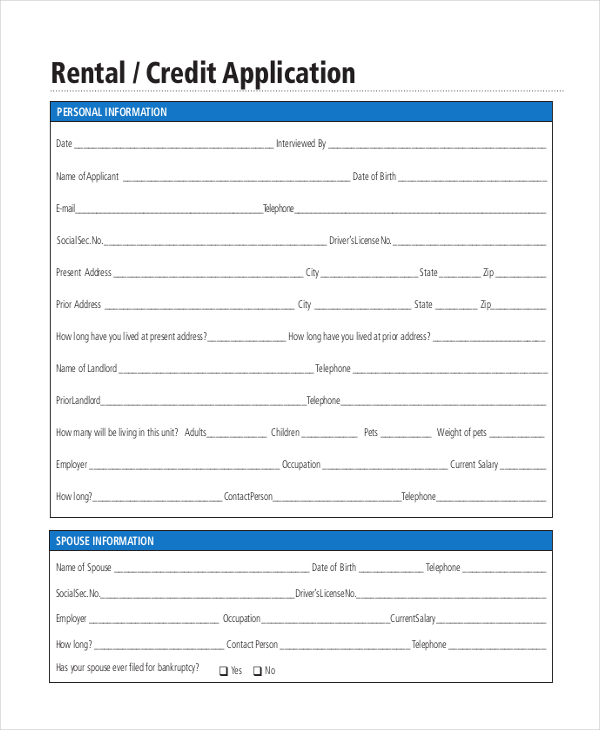

Credit Cards With Primary Car Rental Insurance Coverage Travelsort Rental Insurance Rental Credit Card

Use one of the following forms when filing.

. While the rules vary from state to state there are a few things that remain somewhat consistent across state lines. By answering the questions on the qualification record taxpayers can determine if they qualify to claim the nonrefundable renters credit. You must have been a resident of California in the previous tax year You must have a California Adjusted Gross Income or AGI of less than a.

I lived and payed rent in an apartment for all of 2017 and part of 2018. Fill out Nonrefundable Renters Credit Qualification Record available in the California income tax return booklet for your own tax records dont send the form to the FTB with your tax return. I was able to claim the Renters Credit on my 2017 return.

The taxpayers California adjusted gross income must be below a. File either a California form 540 complete line 31 540A line 19 or 540 2EZ line 13 tax return. You must legally reside the state where you rent your home.

You were a California resident for the entire year. The property that youve rented for more than half a year mustnt be exempt from the California property tax during that year. O 40078 or less if your filing status is single or marriedRDP filing separately.

It would increase Californias renter tax credit from 60 to 500 for eligible single filers and 1000 for couples as well as single filers. How Do You Claim The CA Renter Credit. A non-refundable credit worth 60 120 for married joint filers that you can apply to your California income tax if you lived in a rental 4.

To claim the renters credit for California all of the following criteria must be met. To claim the renters credit for California all of the following criteria must be met. You must file a tax return.

APPLICATION PROCEDURE All California personal income tax booklets include a Nonrefundable Renters Credit Qualification record. File a Married Filing Separate or RDP Return Did not live with your SpouseRDP during the last six months of the year Furnish over half of the household expenses for your dependent parents home living with you or not Complete the worksheet in the California Instructions for the credit amount. The other eligibility requirements are as follows.

A separate application is not required. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing. You must be a California resident for the tax year youre claiming the renters credit.

You must sign in to vote reply or post Lacerte Tax Sign in for the best experience. Check the box Qualified renter. Heres an in-depth California Renter Credit breakdown.

The taxpayers California adjusted gross income must be below a. Part way through 2018 I moved into a room in a house that I am now paying rent to the homeowners and I am not a member of their family so I am unsure if i can still use the Renters Credit. The way you claim a renters credit your taxes varies from state to state.

Your California adjusted gross income AGI is. The FTB is the state agency that handles the state income tax. Youll need to obtain a Certificate of Rent Paid from your property owner in order to claim the credit.

Who can claim the renters tax credit. Call National Tax Group at 561-257-3436 to start your free assessment. O 80156 or less if you are marriedRDP filing jointly head of.

File your income tax return. Other Tax Saving Opportunities for Renters. Depending upon the CA main form used the output will appear on Line 46 of the Form 540.

In California renters who make less than a certain amount currently 41641 for. Visit Nonrefundable Renters Credit Qualification Record for more information. You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria.

31 so reach out if you dont receive it. California also has an earned income tax credit. The renters who are eligible to receive this tax deduction are different too.

To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. Tax credits help reduce the amount of tax you may owe. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing.

You paid rent for a minimum of six months for your principal residence. The New Jersey tax benefit is interesting because it gives renters a choice as to whether they would prefer a deduction of 18 of rent paid up to 15000 or a credit of 50 on. But a few requirements are consistent no matter where you live.

Use Screen 53013 California Other Credits to enter information for the Renters credit. The Nonrefundable Renters Credit is for California residents who paid rent for their principal residence for at least 6 months in 2021 and whose adjusted gross income does not exceed 45448 90896 for Married Filing Jointly. You may be eligible for one or more tax credits.

Your California adjusted gross income AGI is 45448 or less if your filing status is Single or Married Filing Separately or 90896 or less if you are Married Filing Jointly Head of Household or Qualified Widow er. The Criteria to claim CA Renters Credit The qualifications for claiming the nonrefundable California Renters Credit include the following. In order to qualify for the nonrefundable California renter credit here are the eligibility criteria you need to meet.

You were a resident of California for at least 6 full months during 2021. How you get it. California Resident Income Tax Return Form 540 2EZ line 19.

Have a family with children or help provide money for low-income college students. To claim the CA renters credit Go to Screen 53 Other Credits and select California Other Credits. If you are considering claiming your RD tax credit partner with trusted tax experts.

See How to Generate the California Renters Credit for more information. California tenants could get an expanded renters tax credit if Legislature passes bill backed by Democrats and Republicans. The Nonrefundable Renters Credit is a personal income tax credit that is nonrefundable and can only be used to offset your tax liability.

To claim this credit you must. Lacerte will determine the amount of credit based on the tax return information. Theyre required to give it to you by Jan.

The Renters Tax Credit can be claimed by individuals through the California Franchise Tax Board. Claims for this credit should be made as part of ones annual income tax filing. California Resident Income Tax Return Form 540 line 46.

California Nonresident or Part-Year Resident Income Tax Return line 61. Claiming the renters credit on your taxes.

Renters Insurance Guide Insurance Com Best Renters Insurance Renters Insurance Renter

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

Free 9 Sample Rental Application Forms In Pdf Ms Word Excel

Settlement Agreement Sample Check More At Https Nationalgriefawarenessday Com 39514 Settlemen Divorce Settlement Agreement Debt Settlement Divorce Settlement

Irs Form 540 California Resident Income Tax Return

Safe Auto Insurance Agent Near Me

Geico Auto Insurance Worcester Ma

What Time Does Go Auto Insurance Open

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Metlife Auto Insurance Reviews Bbb

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Cover Auto Insurance Phone Number

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Idplr Updated Almost Daily Plr Products Business Articles Marketing Free

Sample Eviction Notice For Nonpayment Of Rent Check More At Https Nationalgriefawarenessday Com 37720 Sample Eviction Notice Lease Agreement Being A Landlord

Idplr Updated Almost Daily Plr Products Internet Business Spice Things Up Digital